The commitment to a thesis is part of our foundation at Penultimate Capital. A clear framework of ideas allows us to operate with conviction. Our perspectives evolves as the world does. What remains constant is the pursuit of clarity in how and where we invest, and the belief that a deep understanding of the work ahead precedes action. With that, let’s jump in.

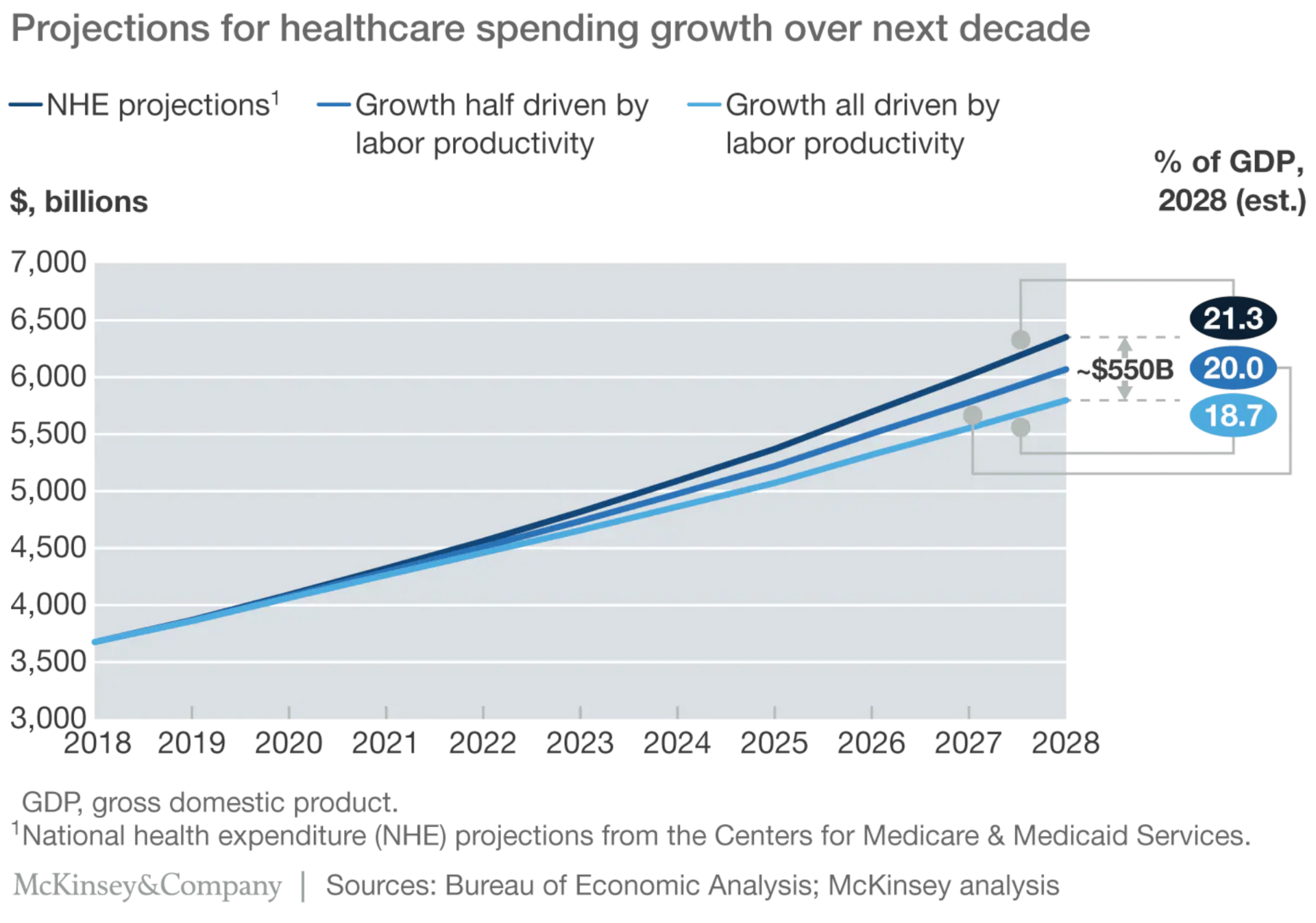

American healthcare is the second largest industry within the economy. It is vast, essential, and paradoxically inefficient. Despite its scale and impact on all of us, it is the only major industry in the US to show negative productivity growth over the past two decades.

Between 2001 and 2016, healthcare produced 9% of national economic growth and nearly 30% of all new jobs. To break it down further, job creation, not labor productivity gains, was responsible for most of the growth in the US healthcare industry during that time.

Growth has largely come from headcount and less from real improvement on how things get done. Looking back, in 2023, hospitals and health systems combined added over 650K jobs, accounting for nearly 1 in 4 jobs in the economy, even as access and outcomes paled in comparison. At the time of publishing, the average cost of employer-sponsored family coverage exceeds $27K per worker with healthcare inflation hovering at nearly 3.5%, and 1 in 3 adults now carries medical debt totaling more than $200 billion.

The takeaway is the system keeps expanding while the value it delivers continues to erode at alarming rates.

In parallel, technology has gone through a tectonic shift since the dot com era. For example, $1 today buys 50,000 times more computing power than it did in 2000 and buys less healthcare due to costs and inflation outpacing efficiency and reform.

This might be a hot take, but healthcare still runs on what we call “Guild Logic,” a structure built for permanence over renewal. We have talked to buyers, key ICPs, and other ecosystem stakeholders and have reason to believe that hospitals and enterprises, on average, take nearly two years to deploy digital solutions, a timeline that would exhaust most startups at the early stage and create anxiety among an investor base that seeks speed and scale. Sometimes innovation in health doesn’t fail because the idea is poor. It fails because of the lack of distribution, sponsorship, advisory support, and consistent access to capital.

The Central Order

At the heart of this inertia sits “The Central Order,” a concentrated community of executives and institutions that shape nearly every major decision in healthcare. It includes the leaders of the 7 publicly traded MCOs (Managed Care Organizations) with ~$700 billion in combined market value, the 33 BCBS CEOs who oversee more than 130 million Americans, and the largest 100 health system leaders who steward more than $720 billion in patient revenue (as of 2024). Not to forget, the 10 largest biopharma companies whose combined market cap exceeds $2.5 trillion, along with the EHR juggernauts and all of its regulatory capture and you reach the network that sets the tempo of the $5 trillion healthcare economy.

To be clear and fair, “The Central Order” provides stability and professional rigor, and without it, the health system as we know it would not function by design. Yet the same structure that ensures reliability also slows the adoption of new ideas. Regulation, legacy systems, and complex hierarchies protect continuity but resist change, so when technology and new business models move faster than the institutions meant to absorb them, friction accumulates. Innovation becomes a matter of permission instead of momentum, but in 2025 the paradigm finally shifted.

Finding Space in The Order

Penultimate Capital invests at the edges of this order, in the connective layers where new infrastructure can integrate with existing systems without waiting for their reform but instead complement and grow alongside them. We look for founders building bridges and scaling walls, and we back them early at Pre-Seed, Seed, and Series A. Our goal is to translate technological velocity into sustainable institutional progress. The next chapter of healthcare will be defined by this tension between stability and speed and by those who learn to align them. Securing consistent support and participation from The Order will be essential to future progress, because as pressures mount from patients, government, innovators, and AI, the traditional levers of control no longer work.

On the private capital side, another dynamic has emerged. Over the past fifteen years, more than $200 billion has flowed into healthcare startups (excluding Bio and Pharma), yet most of that capital has circulated within the same investor networks. 64% of funding came from recurring relationships, and nearly half of the 11,000 companies analyzed since 2007 were backed by repeating investor pairs or trios. This pattern compresses diversity of thinking and reinforces the same slow-moving cycle that innovation is meant to break. Penultimate’s work begins where that cycle ends.

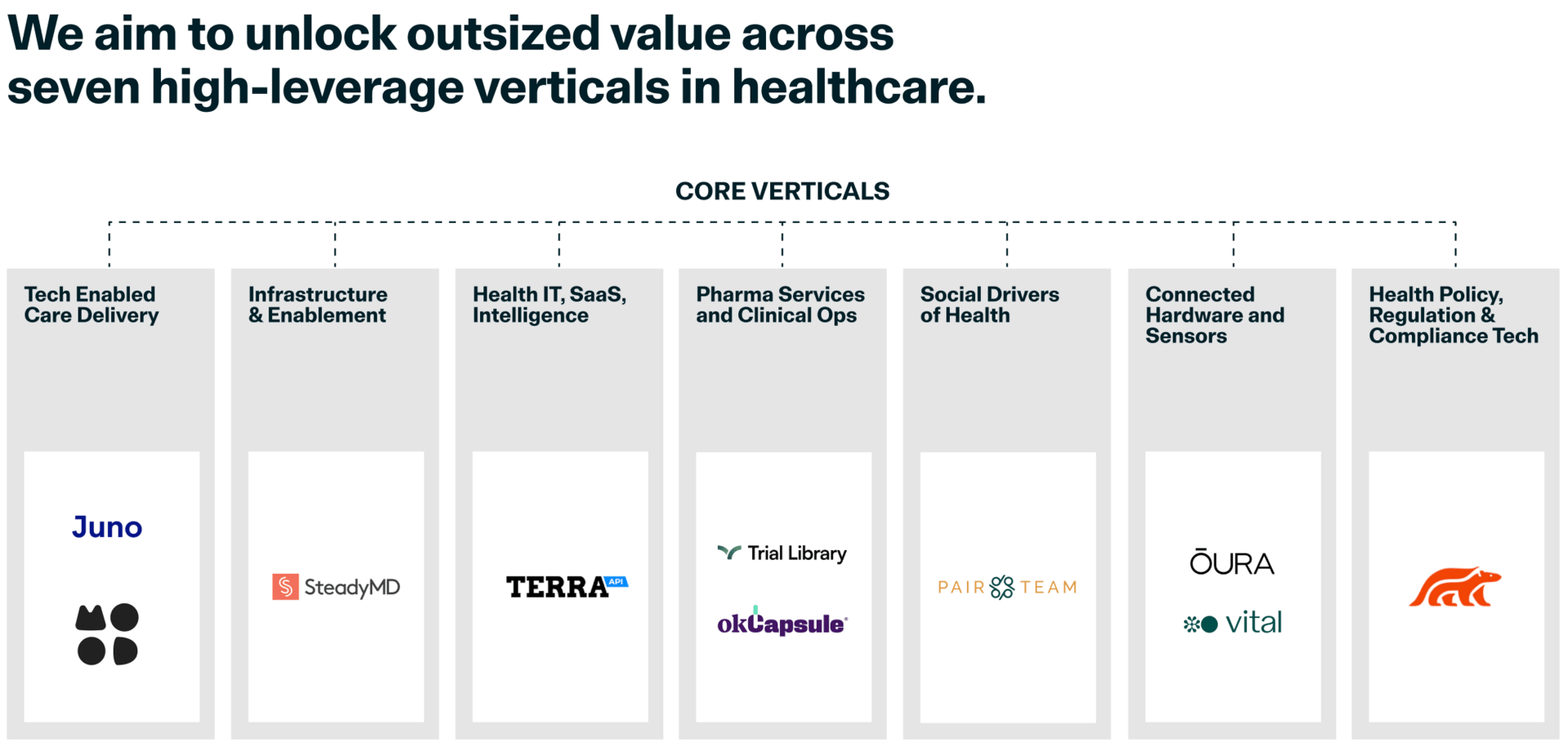

We don’t approach the healthcare opportunity as a collection of micro theses or personal hunches. We have conducted deep need finding and mapped a connected system of markets whose boundaries are dissolving and require multiple catalysts to evolve. Our thesis for Fund I is Full Spectrum Health, the complete arc of the value chain where technology, data, and capital come together to drive LP returns, measurable outcomes, and lasting improvement in health.

This framework captures value creation across infrastructure, software, intelligence, services, and consumer experience. The most durable companies will emerge at the intersection of these verticals. Our approach combines domain expertise with cross-vertical collaboration, allowing our capital to move freely and with the most impact across the system and portfolio.

Logos represent historical investments made by the Partnership not Penultimate Capital.

1. Tech Enabled Care Delivery

The front line of care is decentralizing. We invest in models that extend clinical capability beyond traditional settings. These companies expand access, lower costs, and create continuous data connections between patients and providers.

2. Infrastructure & Enablement

Every transformation begins with infrastructure. We back companies building the interoperability, data liquidity, and compliance rails that allow software and services to scale together.

3. AI & Health IT

Software remains the most efficient lever for change. We fund tools that automate routine tasks, support clinical judgment, and release human capacity to focus on care.

4. Pharma Services and Clinical Operations

Clinical development is being redesigned through automation and disintermediation. We invest in companies building new networks and intelligent platforms that shorten timelines, raise quality, and reduce costs.

5. Social Drivers of Health

Health is shaped as much by environment as by treatment, impacting scalable solutions addressing food access, behavioral health, and community infrastructure, the upstream levers that determine cost and outcomes alike.

6. Connected Hardware and Sensors

As healthcare and consumer technology converge, we selectively invest in connected hardware that turns continuous data into actionable intelligence. These products are anchored by recurring revenue models through reimbursement, hybrid payer frameworks built for global reach.

7. Health Policy, Regulation, and Compliance

Complex rules and slow processes limit change, but they also present opportunity. We invest in companies modernizing payer and government operations, automating compliance, and improving transparency.

Our Pod System

Our product and systems first approach focuses on building strong, commercially viable pathways that improve quality and reduce friction. Healthcare’s complexity demands founders who understand how infrastructure and experience work together.

These are the founders we value most. We help them scale intelligently and connect across complementary domains to build systems that endure. We treat fund and portfolio design the way a founder treats their product because it is in our DNA as we are entrepreneurs ourselves. Precision, iteration, and disciplined building are what we love to compound over time.

Penultimate Pod System Framework

Our operational expertise is embedded directly into each company through curated pods, small, focused teams of healthcare operators, advisors, and specialists who work alongside founders on their most important priorities. These pods run in 4–8 week sprints, helping companies clarify GTM strategies, accelerate traction, and refine execution. As a company grows, pod structure evolves with it. The process shortens the time between early traction and institutional readiness and consistently improves graduation rates across the portfolio.

Each investment strengthens a living network of operators, founders, and insights that reinforce one another. When one company improves data interoperability, another gains leverage in contracting or analytics. This cross-portfolio pollination is the essence of Full Spectrum Health. Our companies do not compete for attention; they share tools, knowledge, and access to gain efficiency and speed.

Portfolio network effects

The next transformation in healthcare will not come from a single breakthrough but from the alignment of economic incentives with human outcomes. We exist to fund that alignment at the Penultimate Step, the moment when understanding turns into movement and movement becomes scale and takeoff.

“No bird soars too high if he soars with his own wings.” -William Blake

Welcome to the Stride.

Julian Eison

Founding Managing Parter

Sources

Eric Larsen Episode — Heart of Healthcare Podcast - Thanks for inspiring body of work and informing key thoughts on market framing.